News – 11.07.25

Buzzacott has been ranked 30th in the Sunday Times Top 100 Apprenticeship Employers 2025!

Buzzacott has been ranked 30th in the Sunday Times Top 100 Apprenticeship Employers 2025 … Read more

Insight – 09.07.25

The importance of ISAE 3402 reports in risk management

Undertake a ISAE 3402 report to help mitigate risk and improve stakeholder trust. … Read more

Upcoming event – 22.07.25

'Aligning purpose with performance' - a joint event by Buzzacott and Rathbones

'Aligning purpose with performance' - a joint webinar by Buzzacott and Rathbones … Read more

Find us quickly

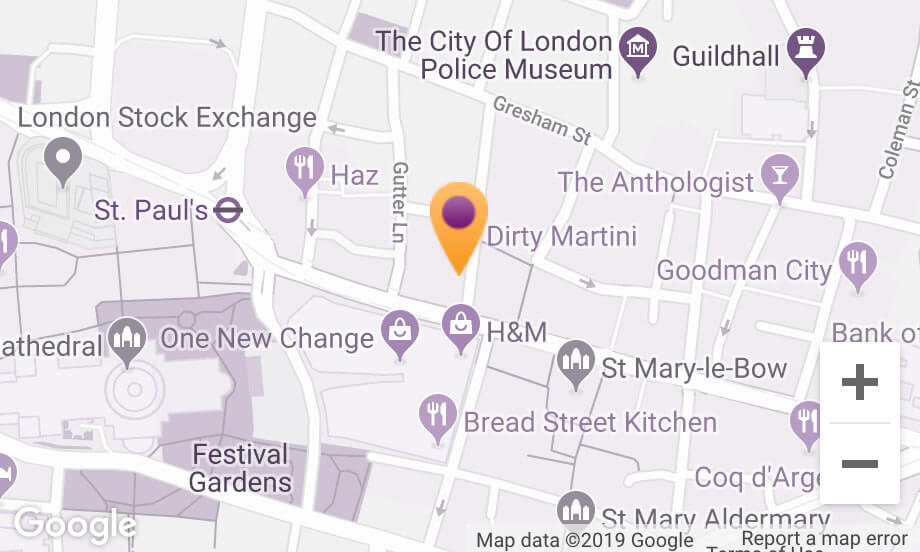

130 Wood Street, London, EC2V 6DL

enquiries@buzzacott.co.uk T +44 (0)20 7556 1200

Whatever you post, whether it be on your Facebook page, Twitter, a forum, or any internet site, that information is available to HMRC and they will look at these sources for information to check your tax return.

One of your obligations is to ensure that your tax return is accurate and complete. HMRC is alerted to various entries in your tax return such as rounded amounts or what HMRC suspects are estimated amounts as they will then believe that your record-keeping is not being complete.

If there are any year on year inconsistencies or variances in your tax returns, for example, if you have lived off non-taxable incomes one year or there's been a change in your business performance such as your gross profit rates, you should make entries in your additional information box, also known as the white box, to explain this. That way, when HMRC risk assesses your return, you will have made this situation aware to them.

Call us today on +44 (0)20 7710 3389 or fill in the form below and a member of our team will be in touch. All communications are in the strictest confidence.

We use necessary cookies to make our site work. We’d also like to set optional analytics and marketing cookies. We won't set these cookies unless you choose to turn these cookies on. Using this tool will also set a cookie on your device to remember your preferences.

For more information about the cookies we use, see our Cookies page.

Please be aware:

— If you delete all your cookies you will have to update your preferences with us again.

— If you use a different device or browser you will have to tell us your preferences again.

Necessary cookies help make a website usable by enabling basic functions like page navigation and access to secure areas of the website. The website cannot function properly without these cookies.

Analytics cookies help us to understand how visitors interact with our website by collecting and reporting information anonymously.

Marketing cookies are used to track visitors across websites. The intention is to display ads that are relevant and engaging for the individual user and thereby more valuable for publishers and third party advertisers.

.jpg)