News – 16.04.25

Buzzacott advises Karnell Group AB (publ) on the acquisition of Warwick SASCo Ltd

Find out how Buzzacott advises Karnell Group AB (publ) on the acquisition of Warwick SASCo Ltd … Read more

Insight – 23.04.25

Charity Fraud: Trends and Prevention Strategies

Learn more about Charity Fraud and the current trends and prevention strategies … Read more

Upcoming event – 08.05.25

A practical guide to navigating charity investments

Join our expert-led webinar to gain key insights into how charities can develop and maintain a strong investment approach that aligns with their mission and objectives. … Read more

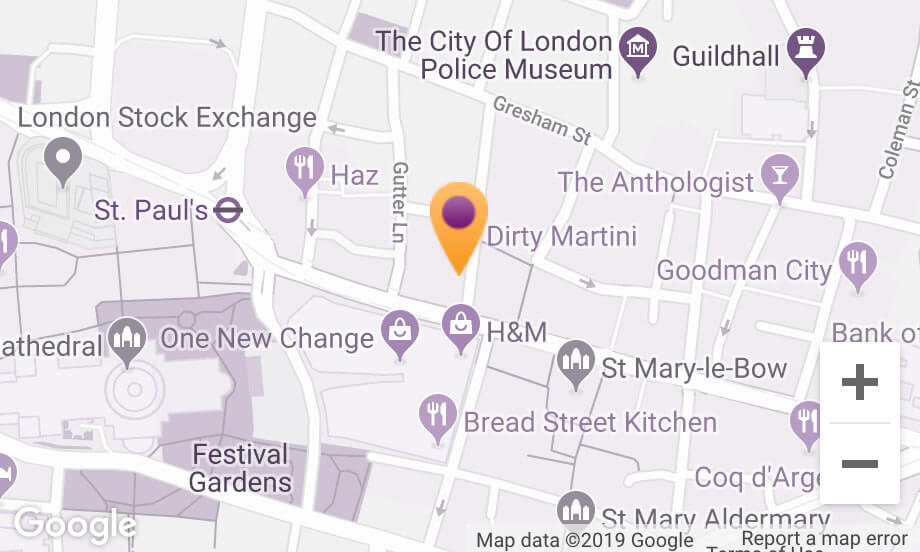

Find us quickly

130 Wood Street, London, EC2V 6DL

enquiries@buzzacott.co.uk T +44 (0)20 7556 1200

Get specialist tax investigation help today: +44 (0)20 7710 3389

In certain cases, HMRC has the right to issue Discovery Tax Assessments for the previous 20 years. While the Section 29(1) TMA 1970 Discovery powers are broad, they do have limitations. One should always be alive to challenging the validity of a Discovery Tax Assessment by way of an appeal. Clients/advisers should ask themselves a number of questions:

If the answer is “No” to any of the above then the Discovery Tax Assessment is not valid.

In certain cases, HMRC has the right to issue Discovery Tax Assessments for the previous 20 years. While the Section 29(1) TMA 1970 Discovery powers are broad, they do have limitations. One should always be alive to challenging the validity of a Discovery Tax Assessment by way of an appeal. Clients/advisers should ask themselves a number of questions:

If the answer is “No” to any of the above then the Discovery Tax Assessment is not valid.

We have a proven track record in managing Discovery Tax Assessments to minimise a client’s exposure. As part of our service we review any Discovery Tax Assessment and present you with all available options and what the consequences of taking each option will be. Where appropriate, we will tell you how best to challenge any Discovery Tax Assessment. Should there be any exposure we will protect you from any unnecessary tax, interest and penalty, thus minimising HMRC publishing details about you on its ‘Tax Defaulters’ website. In the most serious of cases, our involvement has prevented our clients from being criminally investigated or, worse still, prosecuted.

Putting it simply, we provide a discreet and comprehensive service that is tailored to meet your unique needs and protect your interests.

Mark and Barbara's team helped me when no one else wanted to know, they met with HMRC on my behalf and managed to reason with them when they were in the wrong. I cannot recommend these guys enough.

Client

Call us today on +44 (0)20 7710 3389 or fill in the form below and a member of our team will be in touch. All communications are in the strictest confidence.

We use necessary cookies to make our site work. We’d also like to set optional analytics and marketing cookies. We won't set these cookies unless you choose to turn these cookies on. Using this tool will also set a cookie on your device to remember your preferences.

For more information about the cookies we use, see our Cookies page.

Please be aware:

— If you delete all your cookies you will have to update your preferences with us again.

— If you use a different device or browser you will have to tell us your preferences again.

Necessary cookies help make a website usable by enabling basic functions like page navigation and access to secure areas of the website. The website cannot function properly without these cookies.

Analytics cookies help us to understand how visitors interact with our website by collecting and reporting information anonymously.

Marketing cookies are used to track visitors across websites. The intention is to display ads that are relevant and engaging for the individual user and thereby more valuable for publishers and third party advertisers.

.jpg)