News – 16.04.25

Buzzacott advises Karnell Group AB (publ) on the acquisition of Warwick SASCo Ltd

Find out how Buzzacott advises Karnell Group AB (publ) on the acquisition of Warwick SASCo Ltd … Read more

Insight – 01.05.25

Transaction readiness – preparing for an exit starts years before sale

One of the key things that impacts transaction outcomes is the preparedness of a business ahead of exit. … Read more

Upcoming event – 14.05.25

Webinar: The new Form PF amendments - June 2025

Book for our Form PF webinar … Read more

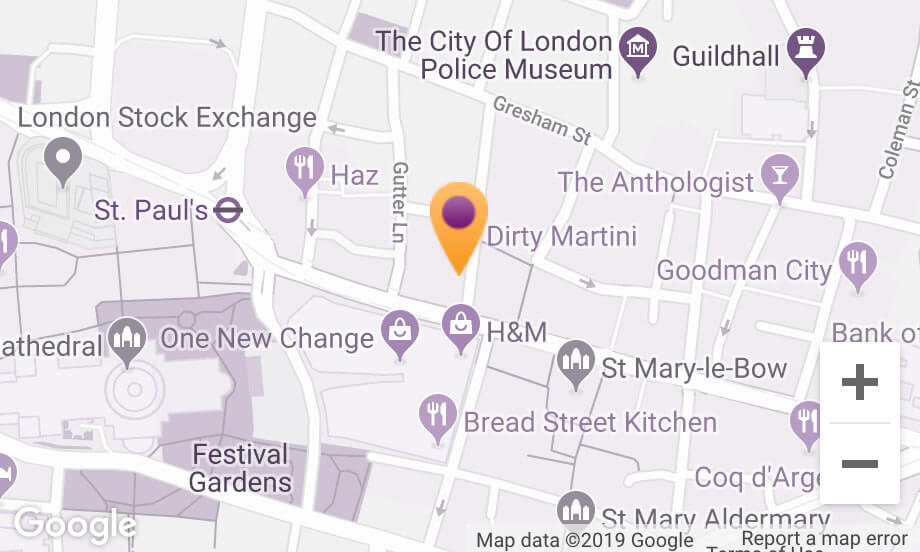

Find us quickly

130 Wood Street, London, EC2V 6DL

enquiries@buzzacott.co.uk T +44 (0)20 7556 1200

Since April 2009, HMRC has the legislative power to transfer company’s tax debts or tax penalties in relation to VAT, NICs or PAYE to one or more company officers by issuing Personal Liability Notices (PLN).

The introduction of PLN was aimed at tackling ‘phoenixism’, which is the term used when a business has become insolvent, and it is then put into liquidation while its assets and operations are moved to a new company with the same personnel.

For a PLN to be issued, there must be evidence to show that ‘on the balance of probabilities’ the failure to pay the correct tax liabilities was attributable to the fraud or neglect by a company officer. A company officer could be a director, a company secretary and/or anyone acting in the role of director.

However, we are seeing more cases where HMRC Officers hold a pre-determined view that the underlying ‘behaviour’ that led to an error was deliberate, without having properly considered the facts. In some cases, taxpayers, who are not represented by Tax Investigation specialists, are unable to adequately present the facts of the case to defend their position. This, combined with an increased push for revenues/yield by HMRC teams can result in an unfair and disproportionate use of PLN by HMRC. It is therefore essential to seek specialist representation, at the earliest opportunity, should you receive a PLN.

Since April 2009, HMRC has the legislative power to transfer company’s tax debts or tax penalties in relation to VAT, NICs or PAYE to one or more company officers by issuing Personal Liability Notices (PLN).

The introduction of PLN was aimed at tackling ‘phoenixism’, which is the term used when a business has become insolvent, and it is then put into liquidation while its assets and operations are moved to a new company with the same personnel.

For a PLN to be issued, there must be evidence to show that ‘on the balance of probabilities’ the failure to pay the correct tax liabilities was attributable to the fraud or neglect by a company officer. A company officer could be a director, a company secretary and/or anyone acting in the role of director.

However, we are seeing more cases where HMRC Officers hold a pre-determined view that the underlying ‘behaviour’ that led to an error was deliberate, without having properly considered the facts. In some cases, taxpayers, who are not represented by Tax Investigation specialists, are unable to adequately present the facts of the case to defend their position. This, combined with an increased push for revenues/yield by HMRC teams can result in an unfair and disproportionate use of PLN by HMRC. It is therefore essential to seek specialist representation, at the earliest opportunity, should you receive a PLN.

Our team, which includes ex-HMRC Fraud Investigation Service Officers, has a proven track record in challenging PLN. We can:

Call us today on +44 (0)20 7710 3389 or fill in the form below and a member of our team will be in touch. All communications are in the strictest confidence.

We use necessary cookies to make our site work. We’d also like to set optional analytics and marketing cookies. We won't set these cookies unless you choose to turn these cookies on. Using this tool will also set a cookie on your device to remember your preferences.

For more information about the cookies we use, see our Cookies page.

Please be aware:

— If you delete all your cookies you will have to update your preferences with us again.

— If you use a different device or browser you will have to tell us your preferences again.

Necessary cookies help make a website usable by enabling basic functions like page navigation and access to secure areas of the website. The website cannot function properly without these cookies.

Analytics cookies help us to understand how visitors interact with our website by collecting and reporting information anonymously.

Marketing cookies are used to track visitors across websites. The intention is to display ads that are relevant and engaging for the individual user and thereby more valuable for publishers and third party advertisers.

.png)

.png)